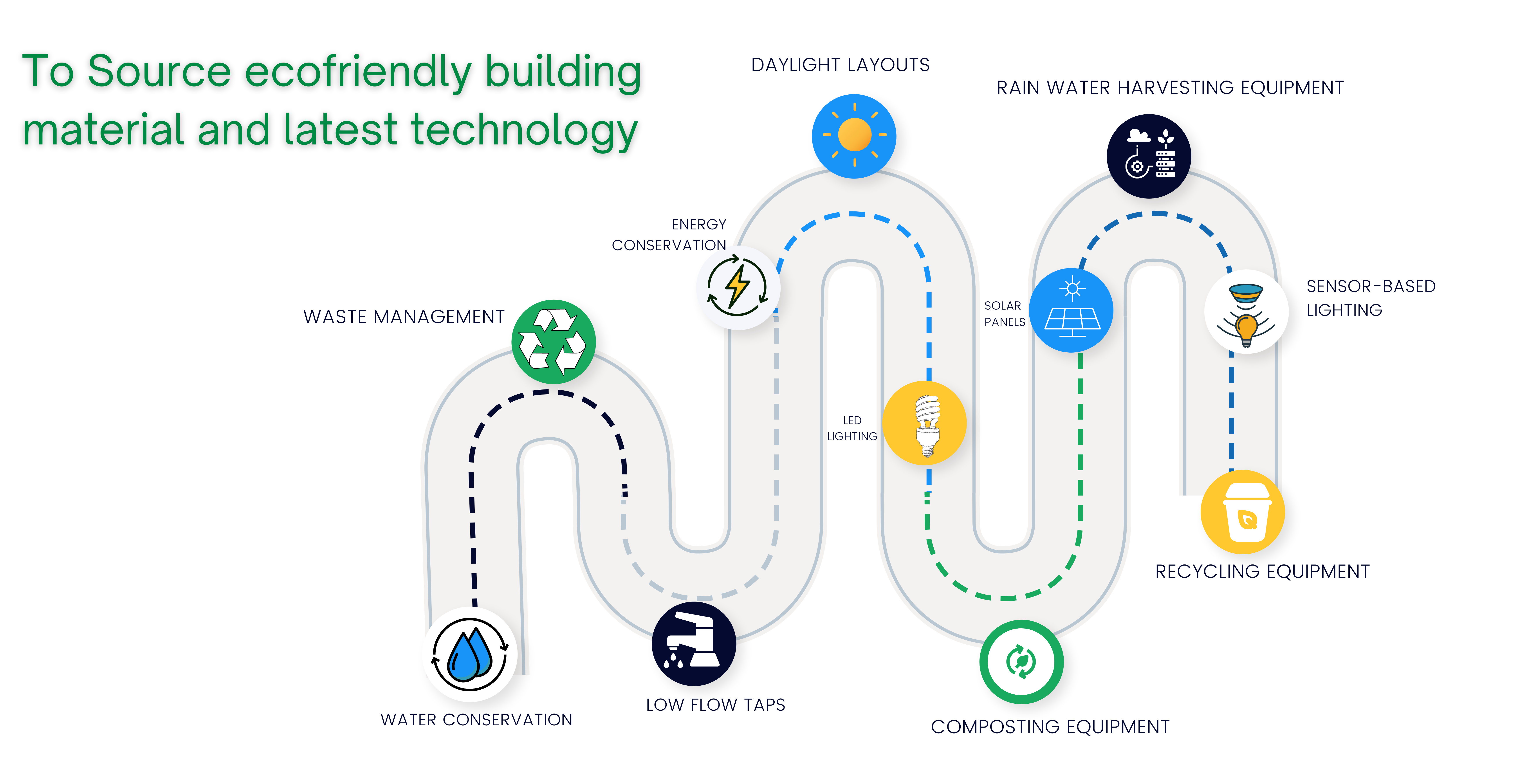

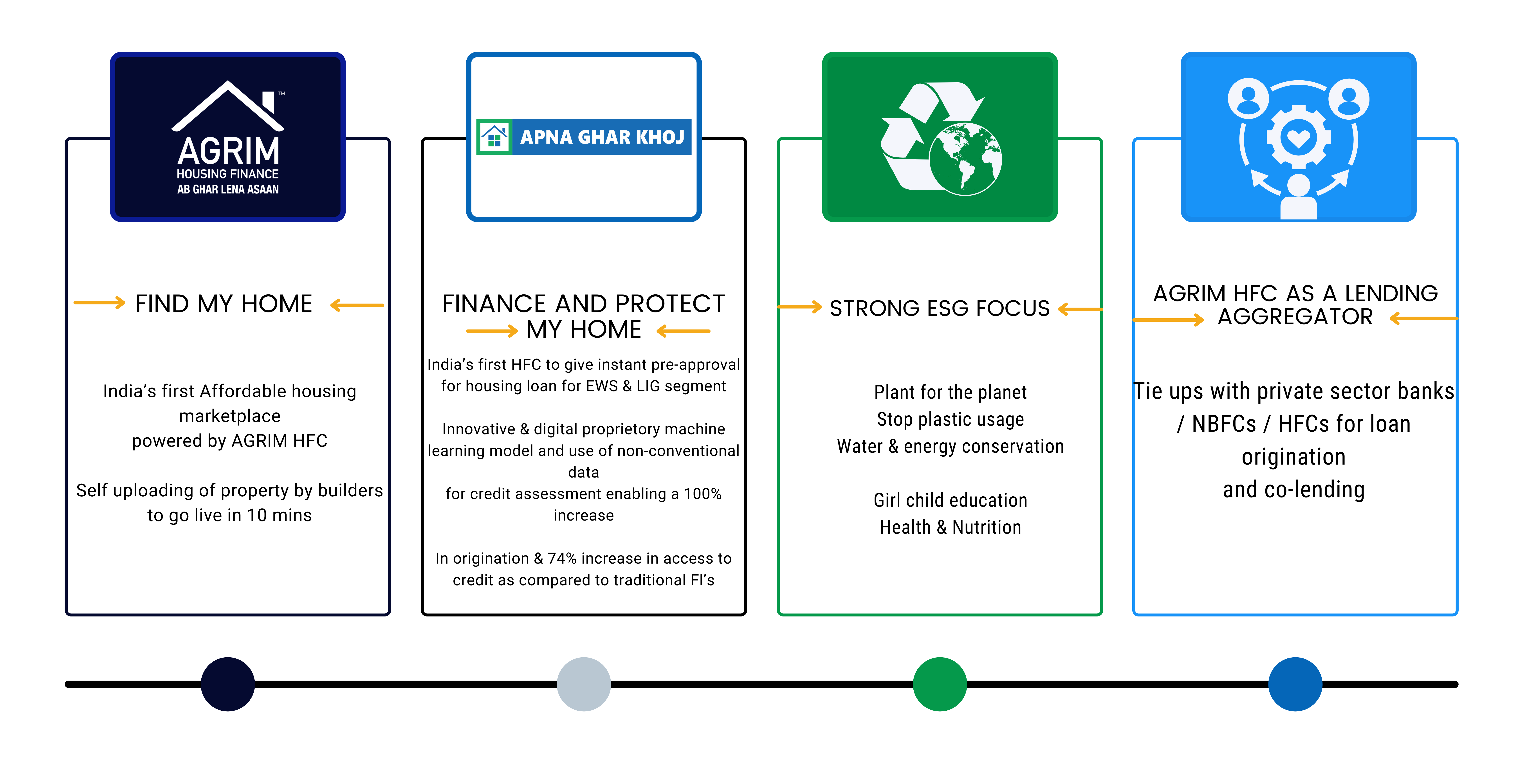

India’s first search portal dedicated to affordable housing showcasing properties of 5-50 lakhs with a choice of environmentally friendly homes.

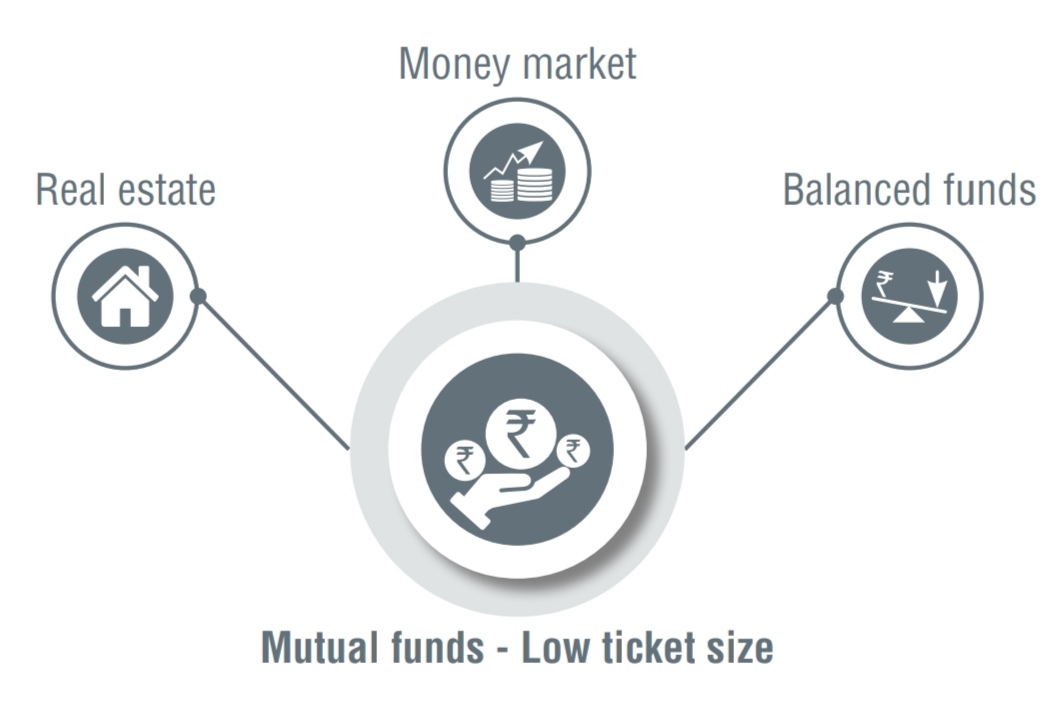

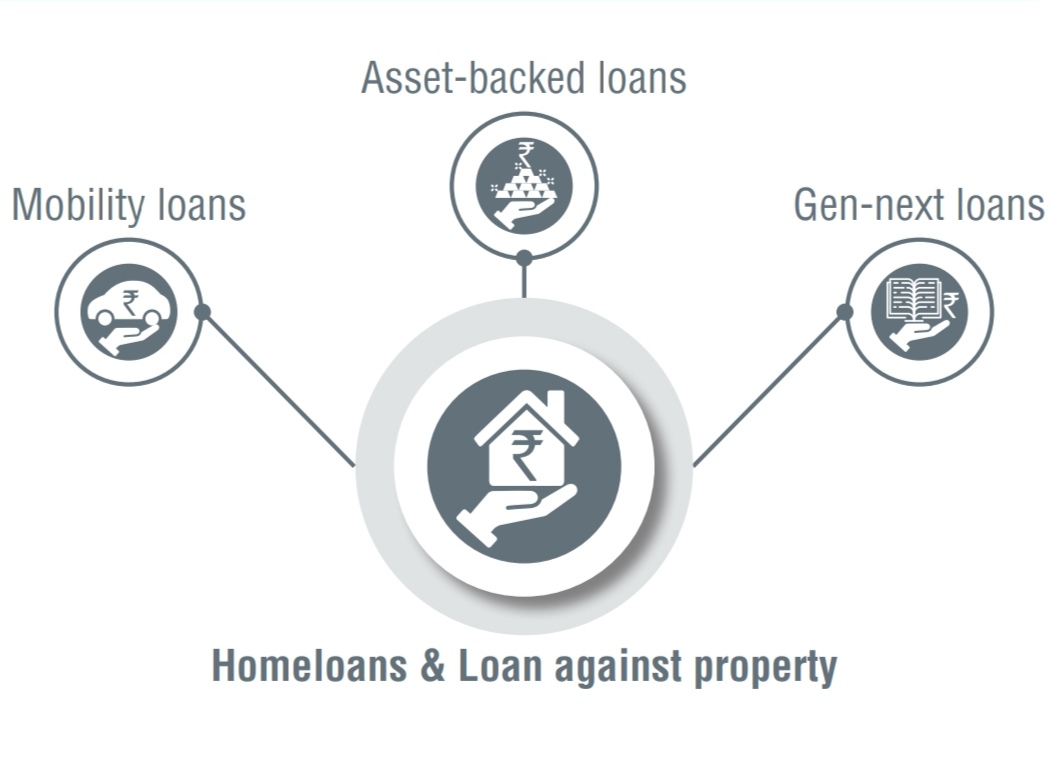

Our B2B partnership approach allows traditional lenders to access the quality lead generation capability of Agrim. Qualified customer leads are used to build our own books and distributed to traditional banks, non-banking finance companies and other housing finance companies. We feel privileged on two counts: Firstly, Agrim HFC is trusted by its partners to act as an aggregator and secondly we are gaining trust to facilitate an increased quantum of loan to allow many more members of our community to buy their first home.