Things to Consider While Taking a Home Loan in Your 40s

Things to Consider While Taking a Home Loan in Your

Our ‘Insta Home Loan App’ provides approval in just 10 minutes for Economically Weaker Section (EWS) and Low Income Group (LIG) households. This innovative solution empowers these households, offering them dignity and the opportunity to achieve their dream of homeownership in India.

Sakshi | Testimonial | Agrim Housing Finance

Mahavir Uttam Khellare | Testimonial | Agrim Housing Finance

Parshuram Chauhan | Testimonial | Agrim Housing Finance

Goraksh Saidane | Testimonial | Agrim Housing Finance

Sanjay Nawale | Testimonial | Agrim Housing Finance

Rameshwar | Testimonial | Agrim Housing Finance

India’s first search portal dedicated to affordable housing showcasing properties of 5-50 lakhs with a choice of environmentally friendly homes.

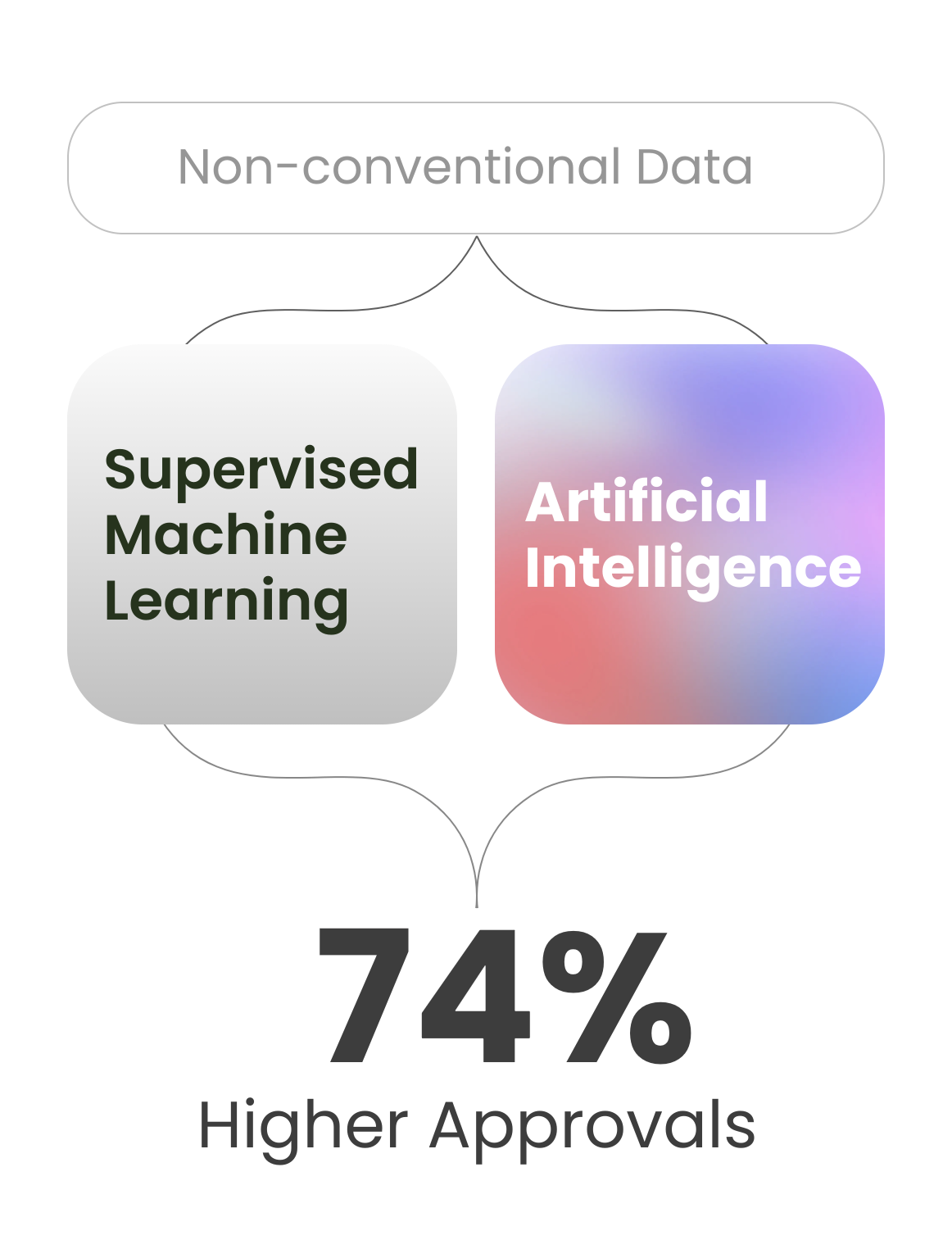

We at Agrim Housing Finance aim to make a difference to improve the livelihoods of the EWS and LIG households who do not have access to formal credit due to the lack of proper documentation and thereby don’t qualify for a loan as part of the traditional credit assessment.

Buy or construct your dream home with our affordable home loans

Take your business to the next level with an easy & quick business loan from Agrim housing finance.

If you’re looking for funding and have a commercial or residential property that you can offer as collateral then Agrim Housing Finance will support self-employed both in the formal and informal segment to fund their business needs through Loan Against Property (LAP) loans.

Our B2B partnership approach allows traditional lenders to access the quality lead generation capability of Agrim. Qualified customer leads are used to build our own books and distributed to traditional banks, non-banking finance companies and other housing finance companies. We feel privileged on two counts: Firstly, Agrim HFC is trusted by its partners to act as an aggregator and secondly we are gaining trust to facilitate an increased quantum of loan to allow many more members of our community to buy their first home.

Ensure healthy lives and promote wellbeing at all ages.

Achieve Gender Equality and empower all women and girls.

Ensure availability and sustainable management of water and sanitation for all

Make cities and human settlements, inclusive, safe resilient and sustainable

Ensure consumption and sustainable production patterns

To shift focus on mental and physical fitness through yoga and propound quintessentially Indian ways of nutrition through well balanced healthy meals.

To spread awareness about girl child education and financial independence of women in among our target segment.

To drive awareness about water conservation through our communication and engage with our audience to generate best methods of water conservation.

To promote green buildings, neighbourhoods and spread awareness about clean and green environment through our “Plant for Planet” initiative.

To create awareness about plastic pollution and responsible consumption of other energy sources, such as electricity, water, fuel and paper.

Things to Consider While Taking a Home Loan in Your

Top-Up Home Loans: When and Why You Should Consider Them

Tips to Manage Your Finances After Taking a Home Loan

Why Owning a Home is Smarter Than Renting in the

The Role of Co-Applicants in Increasing Home Loan Eligibility Buying

The Importance of Income Proof for Home Loan Approval Buying

The core mantra of our affordable home loan solutions is to deliver excellence through innovative products, services along with the pride of owning their own home.

We have taken it upon ourselves to make this social impact to the last mile of the Indian Lower Middle-Class families so that ‘Housing for All’ is achieved. For more information about Agrim please click here

Brand Storytelling | Hyper-connected world | Beyond The Boardroom: Episode 2

Unlock Business Potential | New Entrepreneurs | Beyond The Boardroom: Episode 3

Improve Employee Wellness | Mental Wellbeing | Beyond The Boardroom: Episode 4

Diversity Management | Sustainability | Growth in Beyond The Boardroom Episode 5

Beyond The Board Room | Technology In Property Valuation Services Episode 6

Impact Investing | Relevance & Reach | Beyond The Boardroom: Episode 1